Most Common White Collar Crimes

White collar crime refers to crimes that are designed to produce financial gains using some form of deception. White collar crime is often committed by individuals in the business world, who have access to large amounts of other people’s money. White collar crime has been put on display in the popular films, Boiler Room, The Wolf of Wall Street and Catch Me If You Can.

While white collar crime is no pervasive, here are some examples of the most common white collar crime that are committed across the United States.

Fraud

Fraud is a broad term that covers many different crimes including bank fraud, insurance fraud, forgery and more. Fraud is the intentional deception of a victim by false representation or pretense with the intent of persuading a person to part with property. A common form of fraud that occurs in the internet age is the “Nigerian prince” scam, in which a person receives an email from a “Nigerian prince” claiming to need help.

The “prince” will request a small sum of money and in return when they make to the U.S. they will give riches beyond your wildest dreams. The person at the other end of the email has no intention of reciprocating your “loan”.

Ponzi Scheme

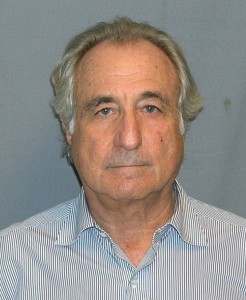

Not a very common form of white collar crime, but perhaps one of the most damaging. Bernie Madoff made headlines in 2008 for operating a massive ponzi scheme that defrauded investors out of millions of dollars.

Not a very common form of white collar crime, but perhaps one of the most damaging. Bernie Madoff made headlines in 2008 for operating a massive ponzi scheme that defrauded investors out of millions of dollars.

A ponzi scheme is a fraudulent investment where a perpetrator pays returns to its investors from new investors rather than profits earned by the operator. Basically, instead of earning an money Madoff simply took the money of new investors to report high earnings to old investors. Madoff simply pocketed all of the money and when it came time for investors to pull their money they discovered it was nowhere to be found.

Insider Trading

Martha Stewart went to prison in 2005 for insider trading after she made trades on stocks utilizing information not available to the public. Insider trading is the trading of a public company’s stock or other securities by individuals with access to nonpublic information about the company. This information can come in many forms, and can either refer to positive or negative information about the company.

For example, if I know that ACME corp will be making a big announcement tomorrow that will undoubtedly improve the value of ACME stock, and I buy a lot of ACME stock at today’s price to sell it tomorrow, then I have committed insider trading.